"The Mortgage Market: Insights from Brokers on Government Intervention"

In this article, we dive into the present status of the home loan market and assemble experiences from dealers on whether government mediation is fundamental.

The home loan market assumes an essential part in the economy, people and families to buy homes and put resources into land.

We the assessments of industry specialists to acquire a more profound comprehension of the market elements and the expected effect of government intercession. a complete examination, we mean to reveal insight into the intricacies of the market and give significant bits of knowledge to policymakers and customers the same.

I. Outline of the Home loan Market:

Significance of the Home loan Market:

- Examining the of the home loan market in working with homeownership and land speculations.

- Featuring its part in the more extensive economy and its effect on monetary security.

Current Economic situations:

- Breaking down the predominant patterns in the home loan market, including financing costs, request, and loaning rehearses.

- Investigating the difficulties and looked by borrowers and banks in the ongoing climate.

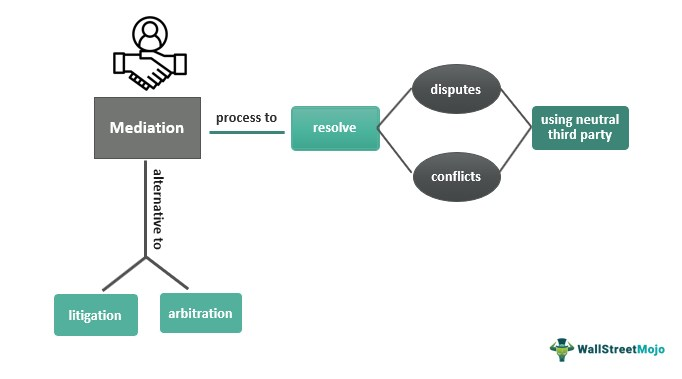

II. Points of view on Government Mediation:

Intermediary Experiences:

- Gathering feelings from contract specialists in regards to the need of government mediation in the home loan market.

- Investigating their perspectives on the possible advantages and downsides of such intercessions.

Contentions Against Government Intercession:

- Examining the contentions set forth by dealers who accept that administration mediation isn't in the home loan market.

- Investigating their reasoning, which might incorporate ,over market contortions and potentially negative side-effects.

Contentions for Government Intercession:

- Introducing the viewpoints of agents who advocate for government to address explicit market difficulties.

- Inspecting their contentions, which might feature the requirement for further developed moderateness, security, or market dependability.

III. Market Elements and Shopper Effect:

Organic market Variables:

- Examining the variables impacting organic market in the home loan market, as lodging stock, development, and segment patterns.

- Examining these elements can influence moderateness and admittance to contract funding.

Contract Guidelines and Purchaser Security:

- Looking at the current guidelines overseeing the home loan market and their effect on security.

- Investigating likely regions for development to guarantee dependable loaning practices and borrower shields.

IV. Evaluating the Requirement for Government Intercession:

Market Proficiency and Contest:

- Assessing the of contest inside the home loan market and evaluating whether it satisfactorily the necessities of borrowers.

- Talking about the expected job of government mediation in advancing business sector productivity and improving rivalry.

Adjusting Chance and Strength:

- Looking at the of government mediation in relieving fundamental dangers and guaranteeing the solidness of ,contract market.

- Talking about the potential compromises between risk the executives and market development.

Conclusion:

The home loan market is a basic part of the economy, influencing homeownership rates, land ventures, and monetary solidness.

While there are varying assessments among agents on the for government intercession, it is fundamental to consider the market elements, buyer influence, and the harmony among guideline and market productivity.

Policymakers should cautiously assess the advantages and disadvantages of to guarantee a solid and manageable home loan market that serves the interests, everything being equal.

:max_bytes(150000):strip_icc()/How-governments-influence-markets_color_rev-a0f613b7ef684cba868aac7efb8818fc.jpg)

Comments

Post a Comment